Financial Reality Faire

Students participate in a mock financial ‘reality’ faire to prepare for life after graduation.

January 20, 2023

On Dec 15, the Norwin High School Business Department held the Financial Reality Faire for all current Money Matters students.

Over the course of the morning, the different classes went to the auxiliary gym where many volunteers as well as the Norwin Teachers Federal Credit Union were there to help students balance their future finances.

“It is important for students to experience what their real life finances may look like so they can be financially responsible from the start,” said Mrs. Martin, high school business teacher.

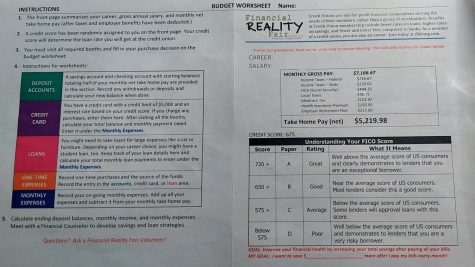

Students were able to select a possible career choice they’d like to pursue, and using the initial salary for it begin to make decisions like transportation, housing, and insurance according.

“It was really interesting to see how all of our individual decisions add up together,” said Bianca White, Money Matters student.

Throughout their initial decisions, students must be mindful of their monthly income so that they were not overspending and had enough money to make ends meet. At the end, students would visit the financial advisor’s table to review their choices.

“I am hoping that the biggest takeaway for the students is to pay yourself first,” said Mrs. Martin, “In class, I try to emphasize to my students that time is the biggest factor when saving and investing.”

Not only is it an enjoyable annual event, but it is also one that opens the eyes of many students and introduces them to what should be expected later in life.

“Spending less to start is always easier than cutting back,” Martin said, “so I was pleased to see that most students were not choosing the most expensive options available but rather being conservative with their spending.